How Restaurants Can Navigate the PPP Loan Forgiveness Program

3 Min Read By Anil Grandhi

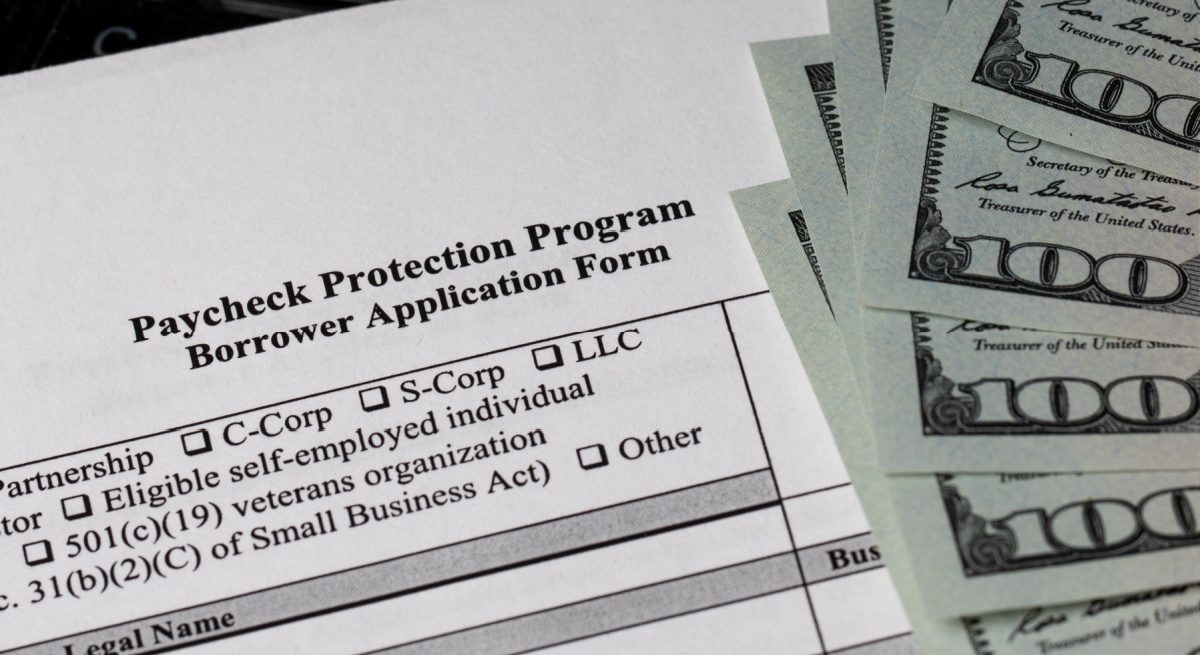

With 50,000 restaurants receiving PPP loans of $150,000 or more keeping thousands of restaurants and restaurant workers afloat, it’s time to find out about the PPP Loan Forgiveness Program. Because that is how it was designed. In April 2020, Congress implemented the PPP program offering businesses forgivable loans to cover costs associated with payroll or certain other operating costs, like mortgage payments or utilities, for a period of 24 weeks (the covered period).

Now that the program has closed, many restaurant loan recipients will want to embark on the forgiveness process. Here is what you need to know in order to ensure you receive the maximum amount of forgiveness available.

Terms for PPP Loan Forgiveness Each recipient must meet certain requirements in order to qualify for the full forgiveness amount. These include:

Spending at least 60 percent of the loan proceeds on payroll Maintaining full-time equivalent (FTE) until the end of the covered period, or with the…

Sorry, You've Reached Your Article Limit.

Register for free with our site to get unlimited articles.

Already registered? Sign in!